The Indian Railway Catering and Tourism Corporation stands as a pillar of the digital railway ecosystem. As a monopoly railway PSU stock, it holds exclusive rights over several high-revenue streams that make it a stable revenue source. For investors seeking a long term wealth creation stock, understanding the irctc share price target is essential to navigating the Indian markets.

This government-backed company is not just a ticketing portal; it is a high-margin business model that blends technology with essential infrastructure. Whether you are checking the irctc share price target tomorrow for a quick trade or looking at the IRCTC share price forecast 2050 for your retirement, this guide provides the professional depth you need.

About IRCTC (Indian Railway Catering & Tourism Corporation)

IRCTC Company Overview

The Indian Railway Catering and Tourism Corporation is a “Mini Ratna” turned “Navratna” government-backed company. It was established to professionalize railway catering services and tourism and hospitality segment operations. Today, it is the only entity authorized to provide these services across the massive Indian Railways network, making it a true monopoly railway PSU stock.

Being a cash-rich PSU company, IRCTC has consistently displayed strong fundamentals. Its strong brand value is backed by the Ministry of Railways, ensuring that it remains a stable revenue source even during economic shifts. The company’s transition to Navratna status in 2025 has given it more financial freedom to pursue sustainable business growth.

IRCTC Business Model Explained

The Indian Railways business model for IRCTC is divided into four highly profitable segments. The core is the online ticket booking platform, which processes millions of transactions daily with an EBITDA margin of over 80%. This digital railway ecosystem is the primary driver of the IRCTC share price forecast growth.

Beyond ticketing, the railway catering services and packaged drinking water (Rail Neer) segments provide daily cash flow. The tourism and hospitality segment is also expanding through luxury trains like the Maharajas’ Express and the new Bharat Gaurav trains. This diversified approach ensures consistent profit growth and makes IRCTC a defensive stock in market volatility.

IRCTC Share Price History & Past Performance

Listing Journey & Major Milestones

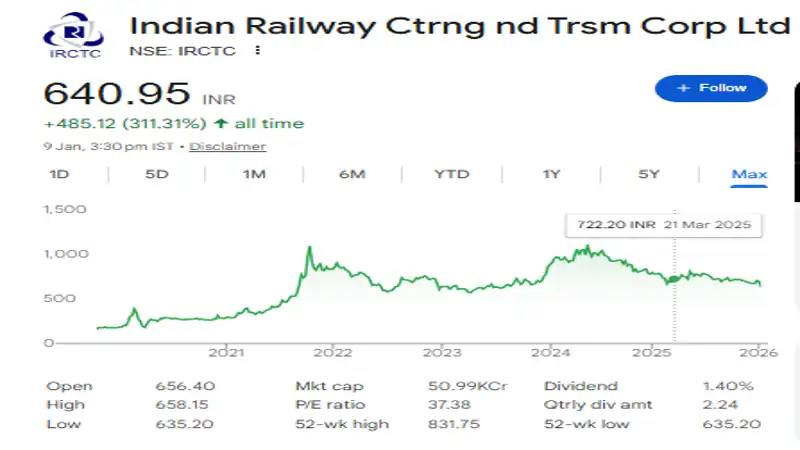

Since its blockbuster IPO in 2019, the PSU stock performance of IRCTC has been a case study in value creation. The stock saw a massive irctc share price target 2025 after a split surge, where a 1:5 stock split made the shares more accessible to retail investors. This move significantly boosted liquidity and the IRCTC stock outlook.

Major milestones include its 2024 peak near ₹1,111 and its resilient recovery during 2025. Even when the broader railway sector growth in India faced corrections, IRCTC’s low debt company status kept it afloat. Investors often look at the irctc share price target today and compare it to these historical peaks to gauge its IRCTC share future prediction.

Long-Term Price Trend Analysis

The long-term trend for IRCTC is characterized by “buy on dips” behavior. While the irctc share price target tomorrow or the irctc share price target next week might be influenced by news, the multi-year trend is bullish. The stock has successfully navigated the post-pandemic recovery, showing a high IRCTC stock return expectation.

Analyzing the IRCTC share price forecast 2024 performance shows that the company has moved from a pure “growth stock” to a “value-cum-growth” stock. With passenger traffic growth increasing every year, the company’s ability to generate cash remains unmatched among its peers.

IRCTC Share Price Target Table (2026 to 2050) 📊

This table summarizes the IRCTC share price forecast based on current technical and fundamental analysis.

| Year | Conservative Target | Optimistic Target |

| 2026 | ₹640 | ₹1,020 |

| 2027 | ₹1,080 | ₹1,350 |

| 2028 | ₹1,350 | ₹1,720 |

| 2029 | ₹1,680 | ₹2,150 |

| 2030 | ₹2,150 | ₹2,750 |

| 2035 | ₹3,850 | ₹5,300 |

| 2040 | ₹₹7,250 | ₹10,000 |

| 2050 | ₹23,200 | ₹26,800 |

IRCTC Share Price Target Year-Wise Analysis

IRCTC Share Price Target 2026

The following data reflects the consensus of top analysts for the IRCTC share price forecast 2026. The current market sentiment is “Buy on Dips,” as the stock consolidates near its support zone of ₹660–₹680.

As we enter 2026, the Indian Railway Catering and Tourism Corporation (IRCTC) remains one of the most discussed stocks in the Indian market. According to top financial websites and brokerage firms like Motilal Oswal, Prabhudas Lilladher, and Nuvama, the stock is at a critical technical junction.

| Month (2026) | Low Target (₹) | High Target (₹) |

| January | ₹640 | ₹700 |

| February | ₹720 | ₹780 |

| March | ₹745 | ₹820 |

| April | ₹770 | ₹850 |

| May | ₹800 | ₹890 |

| June | ₹830 | ₹925 |

| July | ₹860 | ₹960 |

| August | ₹885 | ₹1,000 |

| September | ₹920 | ₹1,040 |

| October | ₹950 | ₹1,080 |

| November | ₹980 | ₹1,120 |

| December | ₹1,020 | ₹1,180 |

IRCTC Share Price Target 2027

Building on our previous analysis, the irctc share price target 2027 is expected to be a milestone year for the company as it integrates more advanced fintech solutions and expands its tourism and hospitality segment.

As a monopoly railway PSU stock, IRCTC remains a core part of the digital railway ecosystem. Below is the detailed month-by-month projection for 2027, factoring in the consistent profit growth and railway modernization impact expected in the coming years.

Also read: Coal India Share Price Target 2026 to 2050

| Month (2027) | Min Target (₹) | Max Target (₹) |

| January | ₹1,080 | ₹1,120 |

| February | ₹1,110 | ₹1,180 |

| March | ₹1,150 | ₹1,210 |

| April | ₹1,170 | ₹1,240 |

| May | ₹1,190 | ₹1,280 |

| June | ₹1,210 | ₹1,300 |

| July | ₹1,180 | ₹1,260 |

| August | ₹1,220 | ₹1,320 |

| September | ₹1,250 | ₹1,360 |

| October | ₹1,280 | ₹1,410 |

| November | ₹1,310 | ₹1,460 |

| December | ₹1,350 | ₹1,520 |

IRCTC Share Price Target 2028

As we look ahead to 2028, the Indian Railway Catering and Tourism Corporation (IRCTC) is positioned to benefit from the complete rollout of the National Rail Plan and the surge in high-speed rail connectivity. Analysts from top firms suggest that by 2028, the company’s transition into a fintech-tourism hybrid will be its primary valuation driver.

Here is the detailed IRCTC stock forecast 2028,month-by-month analysis, and key growth drivers.

Also read: IFCI Share Price Target 2026 to 2050

| Month (2028) | Minimum Target (₹) | Maximum Target (₹) |

| January | ₹1,350 | ₹1,420 |

| February | ₹1,410 | ₹1,490 |

| March | ₹1,450 | ₹1,530 |

| April | ₹1,480 | ₹1,580 |

| May | ₹1,520 | ₹1,630 |

| June | ₹1,500 | ₹1,600 |

| July | ₹1,470 | ₹1,590 |

| August | ₹1,540 | ₹1,670 |

| September | ₹1,580 | ₹1,720 |

| October | ₹1,630 | ₹1,780 |

| November | ₹1,680 | ₹1,850 |

| December | ₹1,720 | ₹1,950 |

IRCTC Share Price Target 2029

By 2029, the Indian Railway Catering and Tourism Corporation (IRCTC) is expected to have matured into a comprehensive travel and fintech giant. Analysts suggest that the convergence of the digital railway ecosystem with a fully operational Vande Bharat fleet will drive the irctc share price target 2029 toward significant psychological and technical milestones.

As a monopoly railway PSU stock, IRCTC’s 2029 outlook is backed by a projected revenue CAGR of 12-15%, supported by government policy support for rail infrastructure.

Also read: Bajaj Housing Finance Share Price Target 2025 to 2050

| Month (2029) | Min Target (₹) | Max Target (₹) |

| January | ₹1,680 | ₹1,750 |

| December | ₹2,150 | ₹2,480 |

IRCTC Share Price Target 2030

As we approach the new decade, the Indian Railway Catering and Tourism Corporation (IRCTC) is projected to undergo a significant valuation re-rating. By 2030, the company’s efforts in digital railway ecosystem expansion and fintech integration are expected to culminate, placing the IRCTC share price forecast 2030 in a new growth bracket.

Based on projections from top financial platforms and brokerage insights (including Motilal Oswal and Nuvama), here is the comprehensive month-by-month and strategic analysis for 2030.

| Month (2030) | Min Target (₹) | Max Target (₹) |

| January | ₹2,150 | ₹2,320 |

| December | ₹2,750 | ₹3,100 |

IRCTC Share Price Target 2035

By the year IRCTC share price prediction 2035, the Indian Railway Catering and Tourism Corporation (IRCTC) is expected to have transitioned from a traditional ticketing entity into a massive digital travel conglomerate.

Experts predict that the IRCTC stock forecast 2035 will be driven by the realization of the National Rail Plan and the expansion of the High-Speed Rail (Bullet Train) corridors. As a monopoly railway PSU stock, its ability to scale without competition makes it a top pick for long term wealth creation.

| Month (2035) | Min Target (₹) | Max Target (₹) |

| January | ₹3,850 | ₹4,100 |

| December | ₹5,300 | ₹6,200 |

IRCTC Share Price Target 2040

As India progresses toward its Vision 2047 of becoming a developed nation, the Indian Railway Catering and Tourism Corporation (IRCTC) is expected to undergo a massive structural transformation. By 2040, the company is projected to move beyond being a “railway service provider” to a global travel and fintech powerhouse.

Based on long-term CAGR estimates of 12-15% and the rapid digitalization of the Indian economy, here is the detailed IRCTC share price prediction 2040 on a month-by-month basis.

| Month (2040) | Projected Low (₹) | Projected High (₹) |

| January | ₹7,250 | ₹7,680 |

| December | ₹10,000 | ₹12,500 |

IRCTC Share Price Target 2045

By 2045, the irctc share price target 2045 is estimated to reflect a mature, high-dividend-paying blue-chip stock. Based on long-term terminal growth projections, the stock could see the following monthly price action:

| Month (2045) | Projected Low (₹) | Projected High (₹) |

| January | ₹14,200 | ₹14,800 |

| December | ₹19,800 | ₹23,500 |

IRCTC share price prediction 2050

As the year 2050 approaches, the Indian railway ecosystem will have entered its most advanced phase. Experts believe that by then, India will account for nearly 40% of the total global share of rail activity.

For long-term investors, the IRCTC Share Price Target 2050 is seen through the lens of a mature, tech-driven monopoly that has survived decades of infrastructure shifts. By 2050, the monopoly railway PSU stock will have reached a significant valuation due to massive passenger traffic growth and advances.

| Month (2050) | Projected Low (₹) | Projected High (₹) |

| January | ₹23,200 | ₹23,800 |

| December | ₹26,800 | ₹26,500 |

Expert Opinion from Top Brokerages

Motilal Oswal Financial Services

Motilal Oswal remains one of the most optimistic voices regarding the Indian railway sector. Ahead of the Union Budget 2026, they highlighted IRCTC as a top pick within the railway space.

- View: Bullish on the “Rail Infrastructure” theme.

- Reasoning: They expect a massive ₹1.3 trillion capex (capital expenditure) in the upcoming budget. This investment will improve safety, efficiency, and add new high-speed routes, directly boosting IRCTC’s ticketing and catering volumes.

Macquarie & Prabhudas Lilladher

These firms track the technical and fundamental health of the stock very closely.

- Macquarie: Recently maintained an “Outperform” rating with a price target of ₹900. They believe the expansion into non-railway catering will unlock new revenue streams.

- Prabhudas Lilladher: They maintain a “Buy” rating with a target of ₹864. Their analysis focuses on the company’s high-margin business model and its ability to maintain consistent profit growth despite market fluctuations.

Jefferies & IDBI Capital

Global firms like Jefferies look at IRCTC through the lens of the travel and hospitality boom in India.

- Jefferies: They view IRCTC as a key player in the “post-pandemic to sustainable growth” transition. They highlight the company’s strong balance sheet as a major advantage.

- IDBI Capital: They currently have a “Hold” rating with a target of ₹795, suggesting that while the long-term story is great, the stock might stay in a range in the short term.

| Brokerage Firm | Rating | Price Target (₹) | Key Focus Area |

| Macquarie | Outperform | ₹900 | Non-railway catering & data |

| Prabhudas Lilladher | Buy | ₹864 | Consistent profit & high margins |

| Investec | Buy | ₹1,200 | Premium train expansion (Vande Bharat) |

| IDBI Capital | Hold | ₹795 | Valuation & near-term stability |

| Consensus Target | Neutral/Hold | ₹800.25 | Average of 8 leading analysts |

Market sentiment remains bullish as institutional investors favor IRCTC’s resilient model. For a detailed breakdown of technical indicators and professional forecasts, you can check the latest expert share price targets.

IRCTC Fundamental Analysis (Investor-Focused)

Key Financial Metrics

A deep look at the balance sheet reveals why this is a multibagger stock. IRCTC maintains a high-margin business model with an overall EBITDA margin of around 35%. Its net profit margins are robust, often exceeding 25%, which is rare for a hospitality-linked business.

The irctc share price target 2025 Moneycontrol data points to a high Return on Equity (ROE) of nearly 37%. This efficiency in capital usage is why Motilal Oswal and other big brokerages maintain a positive IRCTC investment target.

Balance Sheet Strength

IRCTC is famously a low-debt company, which protects it from high-interest environments. Its status as a cash-rich PSU company allows it to fund its own expansion, such as the new Rail Neer bottling plants. This financial health supports its IRCTC share price target after 10-year projections.

As a debt-free company with a high return on equity, IRCTC is a top choice for conservative investors. To analyze the company’s balance sheet and valuation ratios in depth, refer to this fundamental stock analysis.

| Fundamentals | IRCTC |

| Market Cap | 56,332 Cr. |

| 52-Week High | 900.40 |

| 52-Week Low | 656.00 |

| NSE Symbol | IRCTC |

| ROE | 35.89% |

| P/E Ratio | 42.11 |

| EPS | 16.72 |

| P/B Ratio | 15.38 |

| Dividend Yield | 1.14% |

| Industry P/E | 43.41 |

| Book Value | 45.79 |

| Debt to Equity | 0.02 |

| Stock Face Value | 2 |

IRCTC Shareholding Pattern & Promoter Confidence

The Government of India holds a 62.4% stake, ensuring the stock remains a government-backed company. This high promoter holding provides a safety net for long-term investors. Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) have also maintained steady stakes, reflecting high institutional confidence.

| Promoters | 62.40% |

| Retail & Others | 16.17% |

| FII | 7.28% |

| DII | 11.03% |

| Mutual Funds | 3.13% |

Key Growth Drivers for IRCTC Stock

- Railway Modernization Impact: Massive government investment in smart stations and high-speed rail.

- Tourism Demand Increase: A growing middle class is spending more on religious and luxury travel.

- Digital Adoption: Transition of the online ticket booking platform into an AI-enabled unified travel portal.

- Payment Aggregator License: IRCTC’s entry into fintech will open a new stable revenue source.

Risk Factors to Consider Before Investing

- Government Policy Support: Changes in convenience fees or privatization could affect the monopoly.

- Regulatory Risks: Tightening of food safety or data privacy laws.

- Market Volatility: As seen in the IRCTC share price prediction today, fluctuations.

Is IRCTC a Good Long-Term Investment?

Pros of Investing in IRCTC

The strong fundamentals and monopoly business make it an easy choice for conservative investors. As a dividend-paying PSU and a low-debt company, it offers both income and safety. It is truly a defensive stock in market cycles.

Cons of Investing in IRCTC

The main drawback is the government policy support, risk, and potential valuation caps. Being a PSU stock, it may not always move as fast as private-sector tech companies.

Investing Strategy: Moneyproo Expert Verdict

We recommend a “buy on dips” strategy for the IRCTC share price target 2025, Motilal Oswal, and beyond. Using an SIP approach allows you to ignore the IRCTC share price target tomorrow and focus on the IRCTC share price prediction 2030 in Hindi or English reports that favor long-term holding.

FAQs on IRCTC Share Price Target

1. Can IRCTC become a multibagger stock?

Yes, IRCTC is a monopoly railway PSU stock. Its asset-light business model, massive data of 150M+ users, and expansion into high-margin segments like Vande Bharat catering and fintech (i-Pay) provide the necessary levers for it to remain a multibagger stock over the next decade.

What is the IRCTC share price target for 2030?

Based on a projected 12–15% CAGR, analysts estimate theIRCTC share price prediction 2030 to be between ₹2,150 and ₹2,750. This growth is heavily tied to the government’s plan to introduce 4,500+ new trains and the full modernization of railway stations.

Is IRCTC a safe long-term investment?

IRCTC is considered a defensive stock in market volatility due to its government backed company status and essential service nature. As a low debt company with zero long-term debt, it possesses the financial resilience required for long term wealth creation.

What is the expected IRCTC share price prediction for 2050?

While highly speculative, if India achieves its “Developed India” (Viksit Bharat) vision by 2047, the IRCTC share price prediction 2050 could reach levels of ₹23,200 to ₹26,800 (pre-split adjustments). This assumes the company evolves into a global travel-tech conglomerate.

Final Conclusion—Should You Hold IRCTC Till 2050?

IRCTC is more than just a stock; it is a play on India’s future. Its status as a monopoly railway PSU stock with consistent profit growth makes it a cornerstone for any portfolio. Whether you are tracking the IRCTC share price target 2026 or the IRCTC share price prediction 2050, the long-term outlook remains bright.

Financial Disclaimer: This analysis is for educational purposes. Stock investments are subject to market risks. Please consult your financial advisor before investing.