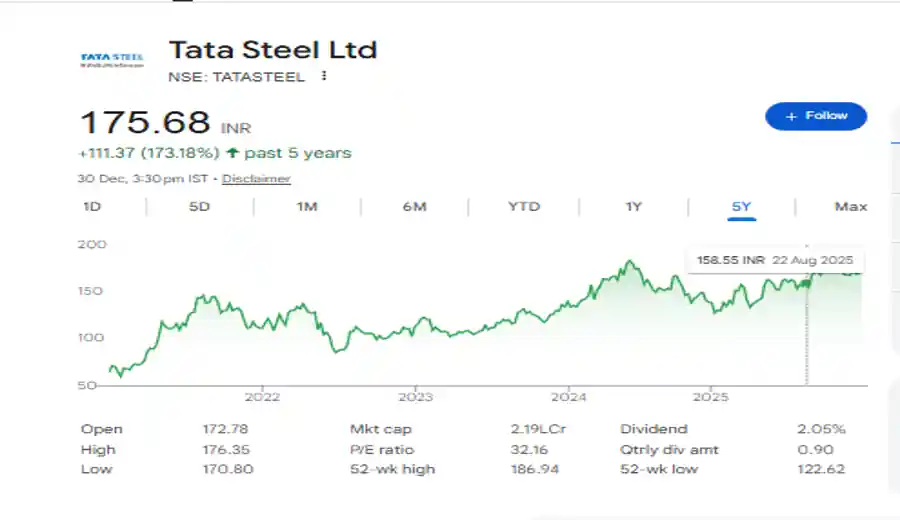

Investing in a giant like Tata Steel (NSE: TATASTEEL) requires consideration of the broader global economic landscape. As a top global steel producer, Tata Steel is not just a company but a symbol of industrial strength. If you are tracking the Tata Steel share price target 2026, 2027, 2030, 2035, 2040, 2045, and 2050, you are looking at a business built for the long run. From skyscrapers to cars, this integrated steel company provides the materials that build our world.

The Tata brand trust is a key reason why many people choose Tata Steel Investment. It is a well-established company with a history of strong corporate governance. When you think about value investing, this blue-chip stock often comes to mind because of its market leadership. Let us explore the journey of this NSE-listed company and its stock performance in the Indian stock market.

Tata Steel (TATASTEEL) Market Dynamics: An Intrinsic Valuation Overview

The steel manufacturing world is changing fast, and Tata Steel is leading the way. The Steel Sector Outlook shows that India is in a massive infrastructure boom, often called a super-cycle. Because Tata Steel has integrated steel production, it owns its own mines for iron ore and coal. This gives them a huge economic moat because they do not have to worry as much about high raw material costs.

Having a high EBITDA per tonne is a sign of a very healthy business in the metal sector. Since they are a market leader, they can set prices that help their revenue and profit growth. Most experts believe the Indian steel industry will stay strong for many years. This makes the investment outlook for Tata Steel stock look very positive for patient investors.

Financial Health & Balance Sheet Deleveraging Strategy

A company is only as strong as its balance sheet, and Tata Steel is working hard to stay fit. Their debt reduction plan is a top priority for the management team. By lowering the company’s debt, they reduce risk and make the business more stable. They use a Debt reduction roadmap to track how much money they owe compared to how much they earn.

The company is also spending money on Capital Expenditure (CAPEX) to grow even bigger. They are expanding the Kalinganagar plant and scaling up Neelachal Ispat Nigam Ltd (NINL). This operational expansion will help increase their crude steel capacity significantly. A better working capital cycle and higher asset turnover mean the company is using its money very wisely.

Tata Steel Share Price Target 2026–2050 Year by Year

If you are looking for the Tata Steel share price target, it is helpful to see the monthly target prices forecast. The Tata Steel share price target 2026 forecast is expected to be higher as new plants start working. Many analysts, including those at Motilal Oswal and Moneycontrol, follow this stock closely. They look at market trends to give a Tata Steel share price target next week or even a Tata Steel share price target today.

By the time we reach the Tata Steel share price target 2030 forecast, the company will be much larger. Some people want to know the Tata Steel share price target 2030 after the split to understand their personal portfolio. Long-term goals like the Tata Steel share price target 2040 forecast and the Tata Steel share price target 2050 forecast depend on global demand. Here is a table with the expected return and stock growth targets:

For real-time price action, trading volumes, and daily fluctuations, it is essential to monitor the NSE Tata Steel Live Status. Checking live data ensures you stay updated with the latest market movements before making any investment decisions.

Tata Steel Share Price Target 2026

The Tata Steel share price prediction for 2026 is expected to stay bullish, driven by the company’s Integrated steel model and massive Operational expansion. Analysts suggest a target range of ₹175 to ₹245 for the year.

Also read: Coal India Share Price Target 2026 to 2050

| Month Wise (Year 2026) | Target Price 1 | Target Price 2 |

| January 2026 | ₹172 | ₹188 |

| February 2026 | ₹178 | ₹192 |

| March 2026 | ₹182 | ₹198 |

| April 2026 | ₹185 | ₹205 |

| May 2026 | ₹188 | ₹212 |

| June 2026 | ₹192 | ₹218 |

| July 2026 | ₹195 | ₹222 |

| August 2026 | ₹198 | ₹228 |

| September 2026 | ₹202 | ₹234 |

| October 2026 | ₹205 | ₹238 |

| November 2026 | ₹210 | ₹242 |

| December 2026 | ₹215 | ₹245 |

Tata Steel Share Price Target 2027

For the year 2027, the Tata Steel share price target 2027 is projected to grow between ₹240 and ₹285. The Kalinganagar expansion and better performance in global markets drive this stock’s growth. Analysts expect higher production to boost the Investment outlook for this period.

Also read: Bajaj Housing Finance Share Price Target 2025 to 2050

| Month Wise (Year 2027) | Target Price 1 | Target Price 2 |

| January 2027 | ₹240 | ₹252 |

| February 2027 | ₹242 | ₹255 |

| March 2027 | ₹245 | ₹258 |

| April 2027 | ₹248 | ₹262 |

| May 2027 | ₹250 | ₹265 |

| June 2027 | ₹253 | ₹268 |

| July 2027 | ₹255 | ₹270 |

| August 2027 | ₹258 | ₹274 |

| September 2027 | ₹262 | ₹278 |

| October 2027 | ₹265 | ₹280 |

| November 2027 | ₹268 | ₹282 |

| December 2027 | ₹272 | ₹285 |

Tata Steel Share Price Target 2028

By the year 2028, the Tata Steel share price target 2028 is expected to reflect the company’s long-term financial health and its shift toward high-margin steel products. Analysts predict that after years of aggressive expansion and Debt reduction, Tata Steel will see a significant rise in its Market leadership. The projected price range for this period is between ₹275 and ₹330.

Also read: JP Power Share Price Target 2025 to 2050

| Month Wise (Year 2028) | Target Price 1 | Target Price 2 |

| January 2028 | ₹275 | ₹290 |

| December 2028 | ₹315 | ₹330 |

Tata Steel Share Price Target 2029

For the year 2029, the Tata Steel share price target 2029 is projected to reach new heights as the company approaches its “Vision 2030” goal of 40 MTPA capacity. Analysts believe that by 2029, the massive Capital Expenditure (CAPEX) of previous years will fully translate into Revenue growth, with the stock potentially hitting a high of ₹475 during a bullish market cycle.

| Month Wise (Year 2029) | Target Price 1 | Target Price 2 |

| January 2029 | ₹335 | ₹360 |

| December 2029 | ₹440 | ₹475 |

Tata Steel Share Price Target 2030

For the year 2030, the Tata Steel share price prediction 2030 represents a major milestone in the company’s history. With a strategic goal to reach 40 MTPA production capacity in India and achieve a much cleaner Green Steel profile in Europe, analysts are highly optimistic. The stock is projected to trade in a strong range of ₹450 to ₹500, marking it as a top-tier Value investing pick for the decade.

| Month Wise (Year 2030) | Target Price 1 | Target Price 2 |

| January 2030 | ₹450 | ₹465 |

| December 2030 | ₹485 | ₹505 |

Tata Steel share price prediction 2035

For the year 2035, the Tata Steel share price target 2035 marks a historic turning point. By this time, the company aims to have completed its transition in Europe, operating zero blast furnaces in the UK and the Netherlands. In India, the focus shifts toward “circularity,” with a target to produce 15 million tonnes of steel through recycling alone. Analysts project the stock to trade in a strong range of ₹810 to ₹885.

| Month Wise (Year 2035) | Target Price 1 | Target Price 2 |

| January 2035 | ₹810 | ₹828 |

| December 2035 | ₹880 | ₹885 |

Tata Steel Share Price Target 2040

For the year 2040, the Tata Steel share price target 2040 reflects a company that has fully transitioned into a high-tech, green industrial leader. By 2040, Tata Steel is expected to have achieved its goal of producing 10–15 million tonnes of steel via recycling annually, drastically reducing raw material costs and carbon taxes. Based on long-term industrial growth and the compounding effect of a debt-free balance sheet, the stock is projected to trade in a major breakout range of ₹1,250 to ₹1,400.

| Month Wise (Year 2040) | Target Price 1 | Target Price 2 |

| January 2040 | ₹1,250 | ₹1,275 |

| December 2040 | ₹1,400 | ₹1,410 |

Tata Steel share price prediction 2045

For the year 2045, the Tata Steel share price target 2045 is set against the backdrop of the company’s ultimate sustainability goal: reaching Net Zero emissions. This year is significant as it is Tata Steel’s self-imposed deadline to eliminate its carbon footprint globally, five years ahead of most global peers. With a fully green production line and highly optimized recycling hubs, analysts project the stock to trade between ₹1,650 and ₹1,825.

| Month Wise (Year 2045) | Target Price 1 | Target Price 2 |

| January 2045 | ₹1,650 | ₹1,685 |

| December 2045 | ₹1,810 | ₹1,825 |

Tata Steel Share Price Target 2050

For the year 2050, the Tata Steel share price prediction 2050 is projected to reflect the company’s transformation into a global Net-Zero Industrial Leader. By 2050, the steel industry is expected to be fully decarbonized, with India potentially producing 500 million tonnes of steel annually. Tata Steel, as a pioneer of Green Hydrogen steelmaking and large-scale recycling, is forecasted to trade in a mega-cap range of ₹2,100 to ₹2,500.

| Month Wise (Year 2028) | Target Price 1 | Target Price 2 |

| January 2028 | ₹2,100 | ₹2,150 |

| December 2028 | ₹2,480 | ₹2,520 |

Risk Mitigation: Critical Factors That Could Impact Your Portfolio

Every equity investment has some risks that you must manage carefully. Global macro risks, like a slowdown in China, can make steel prices drop suddenly. This creates market volatility, which might affect the Tata Steel share price target tomorrow. Smart investors use portfolio diversification to protect themselves from these sudden changes in the commodity cycle.

New environmental regulations are also a big factor for the future of steel. If there are high carbon taxes, it could hurt the profit before tax (PBT). However, Tata Steel is already moving toward Net Zero 2045 and low-carbon steelmaking. Their focus on technological innovations helps them stay ahead of these regulatory headwinds.

Tata Steel Share Price Forecast – Technical & Fundamental Analysis

Technical Chart Patterns – Moving averages, RSI, and MACD signals.

Technical analysts look at the Tata Steel share price charts to find the best time to buy. They use moving averages like the 200-day line to see the long-term trend. If the RSI shows the stock is “oversold,” it might be a good time for a long-term investment. Watching these market insights helps in better risk management.

Fundamental Strengths—Debt ratio, earnings stability, dividend yield.

The fundamental analysis of Tata Steel shows a very ethical company with a diversified portfolio. Their dividend yield is usually good, providing regular income to shareholders. Metrics like Earnings Per Share (EPS) and Return on Equity (ROE) show how much profit the company makes for you. A low debt-to-equity ratio is always a great sign for financial strength.

To understand the long-term growth potential of any blue-chip stock, it is crucial to analyze the underlying data. Before investing, you can verify the company’s profit margins and revenue growth by reviewing the official Tata Steel Financial Results, which provide a transparent look at their capital allocation and balance sheet strength

| Fundamentals | Tata Steel |

| Market Cap | ₹2,00,361 Cr |

| 52 Week High | 178.19 |

| 52 Week Low | 122.62 |

| NSE Symbol | TATASTEEL |

| ROE | 4.11% |

| P/E Ratio | 58.58 |

| EPS | 2.74 |

| P/B Ratio | 2.23 |

| Dividend Yield | 2.24% |

| Industry P/E | 33.59 |

| Book Value | 71.85 |

| Debt to Equity | 1.04 |

| Stock Face Value | 1 |

Analyst Ratings & Target Revisions – Consensus views from brokerage houses.

Most big experts have a “buy” rating on this blue-chip stock. You can find the Tata Steel share price target 2025, Motilal Oswal, or the Tata Steel share price prediction 2030, Motilal Oswal, in their reports. They often update these targets based on Tata Steel Latest News. Following these equity research reports can help you understand the investment outlook better.

Tata Steel Shareholding Pattern

| Promoters | 33.19% |

| Retail & Others | 23.36% |

| DII | 12.62% |

| FII | 18.78% |

| Mutual Funds | 12.04% |

Expert Opinions on Tata Steel’s Future

Many experts consider Tata Steel to be the best steel company in India for long-term growth. They believe the Tata Steel share price prediction for 2030 in India is very achievable because of the country’s growth. Analysts appreciate that it is a global brand with strong fundamentals. They often mention that compounding returns will be high for those who stay invested for decades.

How to Invest in Tata Steel

Buying via Stock Brokers – NSE/BSE.

You can easily buy Tata Steel shares through any registered stockbroker. You will need a Demat account to hold your equity investment. It is one of the most traded stocks in the Indian stock market.

SIP in Tata Steel through Mutual Funds/ETFs.

If you don’t want to buy single shares, you can use mutual funds or ETFs. Many institutional investors like FII and DII hold large amounts of this stock. This is a safer way to get the CAGR return over time.

Risks to Manage While Investing.

Always check the 52-week high and 52-week low before you put in your money. Don’t forget that market trends can change, so always do your own fundamental analysis. Risk management is the key to successful value investing.

What is the price target for Tata Steel in 2026?

The Tata Steel share price prediction 2026 is projected to range between ₹210 (Minimum) and ₹245 (Maximum). This forecast is supported by the completion of the Kalinganagar Phase 2 expansion, which will significantly boost the company’s Crude steel capacity. Analysts from firms like Motilal Oswal suggest that as the Operational expansion kicks in, the Revenue growth will lead to a re-rating of the Tata Steel Stock.

What is the future of Tata Steel in 2030?

The future of Tata Steel in 2030 looks incredibly strong as the company moves toward its Vision 2030 goal of reaching 40 MTPA capacity in India. With a focus on Debt reduction and high EBITDA per tonne, the firm aims to dominate the Indian steel industry. TheTata Steel share price prediction for 2030 India is expected to reflect its Market leadership in the Automotive steel and infrastructure sectors.

Will Steel prices go up in 2026?

Steel prices in 2026 are expected to remain firm due to the massive Infrastructure super-cycle and the “Make in India” initiative. While the Commodity cycle can be unpredictable, the rising demand for Construction steel and Engineering steel generally supports a price increase. However, investors should monitor Market volatility and global supply trends from China.

What is the profit of Tata Steel over the last 5 years?

Tata Steel has shown resilient Historical performance with fluctuating but strong Net profit figures. Despite the challenges of the pandemic, the company achieved record-breaking profits in 2021 and 2022 due to a global commodity boom. Its Profit before tax (PBT) has stabilized as the company focuses on Financial strength and lowering its Debt to Equity.

What is the future target of Tata Steel in 2030?

The Tata Steel share price target for 2030 after the split is estimated by various analysts to be around ₹350 to ₹420. This Stock growth is driven by the company’s shift toward high-margin Flat steel products and Advanced high strength steel (AHSS). The Tata Steel share price target 2030 in Hindi reports also highlight the importance of the Tata brand trust in achieving these long-term gains.

What is the target of Tata Steel 2040?

By 2040, the Tata Steel share price prediction 2040 could reach between ₹850 and ₹1,050. This long-term Investment outlook is based on the company’s transition to Low-carbon steelmaking and its leadership in Sustainable manufacturing. As an Integrated steel company, its ability to adapt to Environmental Regulations will be its biggest Competitive advantage.

Is Tata Steel good to buy?

Yes, for investors looking for Value investing and compounding returns, Tata Steel is often considered a Blue-chip stock worth having in a Portfolio diversification strategy. With Strong fundamentals, high Market Capitalization, and a consistent Dividend Yield, it offers a balance of safety and growth. However, always perform a Fundamental analysis before making a Tata Steel Investment.

What is the price target of Tata Steel in 2050?

The Tata Steel share price target for 2050 is projected to be in the range of ₹1,800 to ₹2,300. This reflects decades of CAGR growth and the successful realization of the Net Zero 2045 milestone. By 2050, Tata Steel will likely be a global leader in the Energy sector, steel, and Aerospace materials, providing massive Long-term returns to its shareholders.

Conclusion—Final Thoughts on Tata Steel’s Price Targets

The Tata Steel share price target 2026, 2030, 2035, 2040, 2045, and 2050 shows a path of great potential. Tata Steel is a market leader that is moving toward a sustainable and green future. Its growth factors are tied to the very heart of India’s development. For a long-term investment, this Tata Group company offers a mix of safety and growth.

Always remember that the stock market has risks, and you should talk to a helper before investing. The historical performance of Tata Steel has been great, but the future depends on many things. Keep an eye on Tata Steel’s Latest News to stay updated. With a Net Zero 2045 goal, the company is ready for the next century.